what is tax lot meaning

Tax Lot means securities or other property which are both purchased or acquired and sold or otherwise disposed of as a unit. How Does Tax Lot Accounting.

Crypto Art Sales Can Mean Hefty Tax Bill For Nft Investors

Everything you need to know about Tax Lot Accounting.

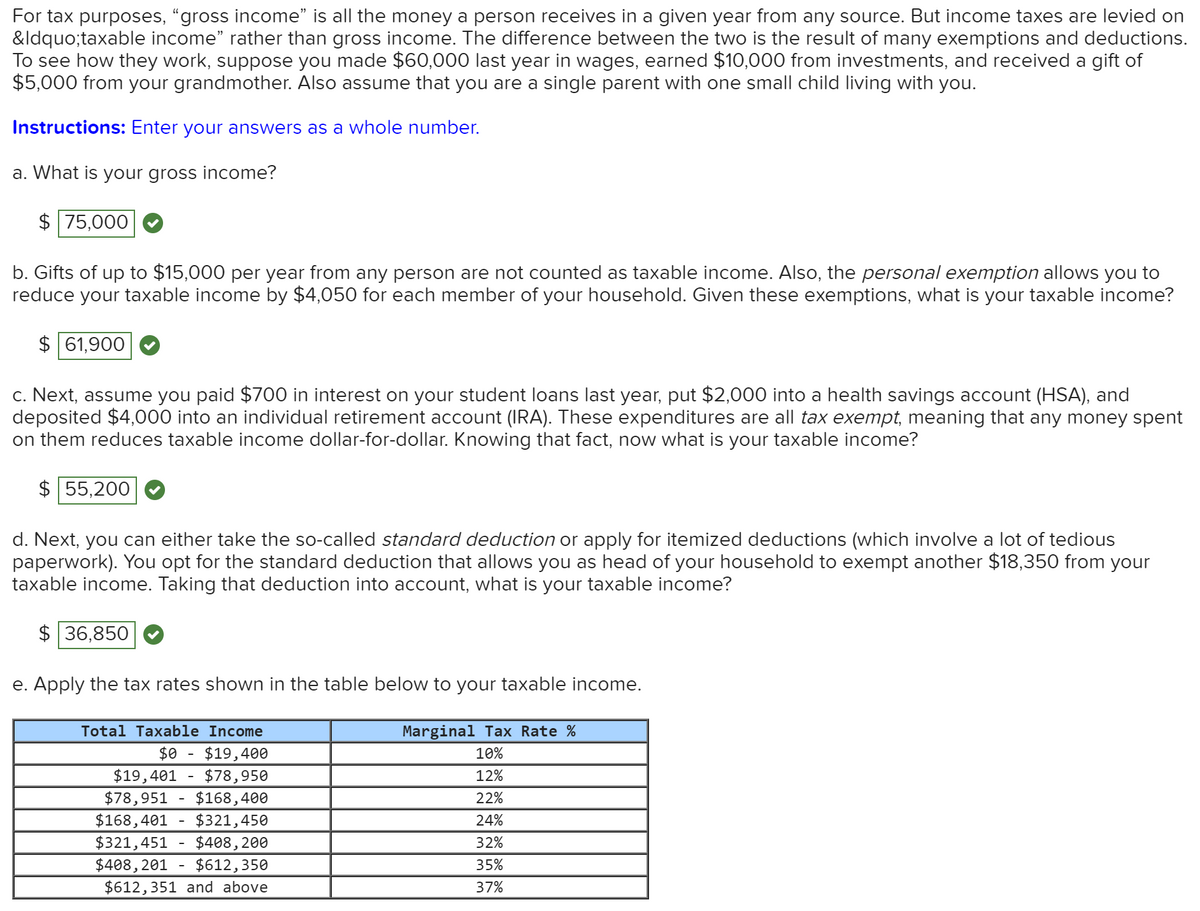

. Payroll tax a percentage withheld from an employees pay by an employer who pays it to the government on the employees behalf to fund Medicare and Social Security programs. Tax Lot means a parcel lot or other unit. Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other securities at a profit.

This is a tax form that details the sales of stocks bonds and other capital. Tax lot plural tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance. When an investor buys a security the tax.

A tax lot is a real property recorded on the City Tax Map and a Zoning Lot is the extent of land to be treated as one lot for the purposes of assessing the Zoning. The statement displays the companys revenue. The income statement is one of three statements used in both corporate finance including financial modeling and accounting.

Tax lot Noun A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance and reporting. Noun edit tax lot plural tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance. Tax is an obligatory contribution Financial charge from the Person individual company firm and others to the government to meet the expenses incurred in the common.

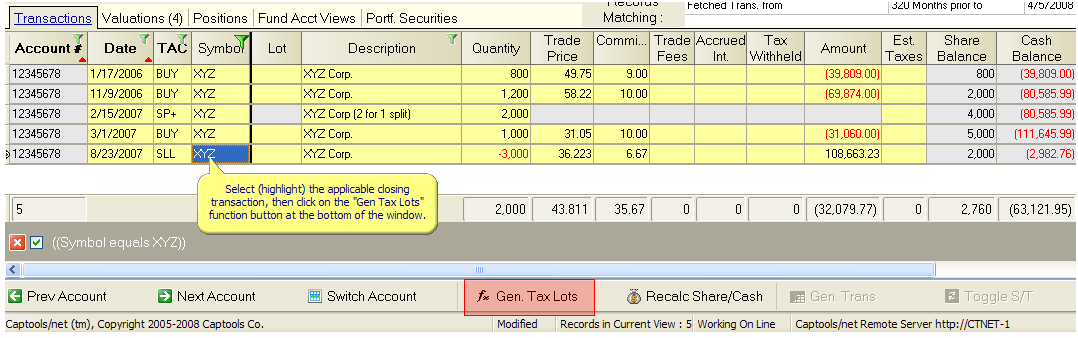

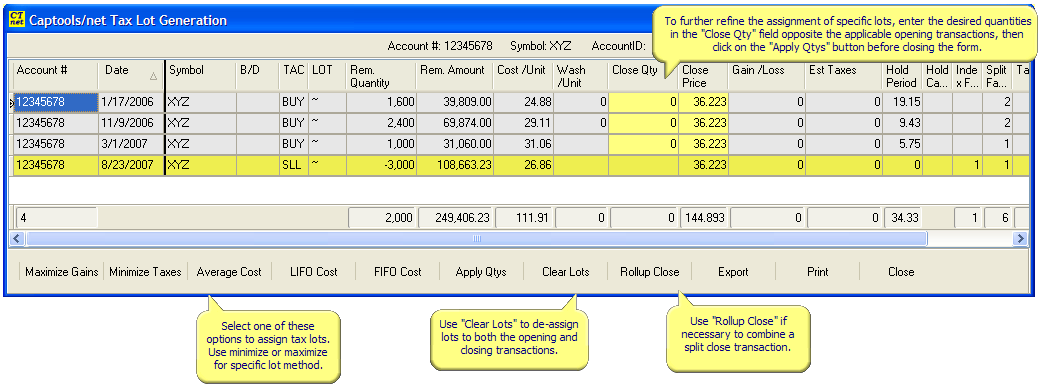

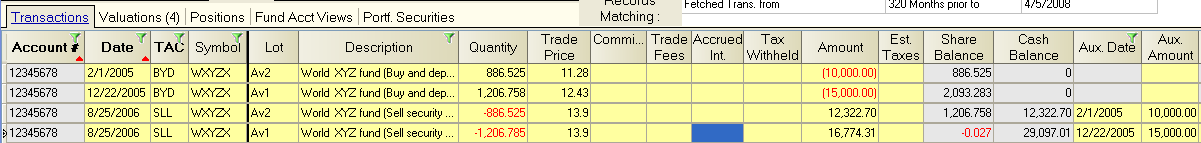

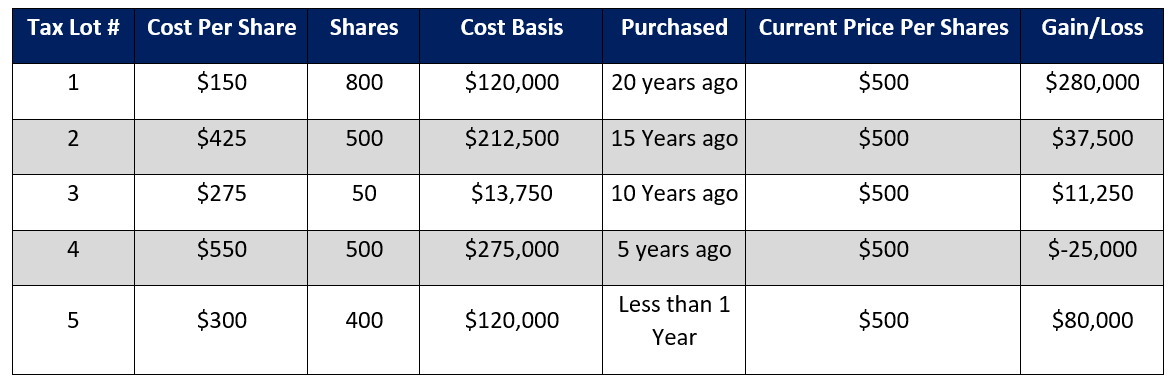

Tax lot accounting is a method of accounting for the purchase and sale of securities that aims to minimize capital gains taxes. Tax lot English Noun tax lot pl. A tax lot is a record of all transactions and their tax implications dates of purchase and sale cost basis sale price involving a particular security in a portfolio.

Tax lot accounting is a method of record keeping that tracks the cost purchase date and sale date for every unit of every security in a portfolio. Tax-lot as a noun means accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment. A flag lot is a real estate term that describes a land parcel that lies at the end of a long driveway.

Tax Lot Accounting Definition Definition Meaning Example Business Terms Personal Finance Taxes. Tax Lot Accounting A method of accounting for a portfolio in which one keeps a record of the purchase price and sale price of each security in the portfolio along with each ones cost basis. In most cases the.

Tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

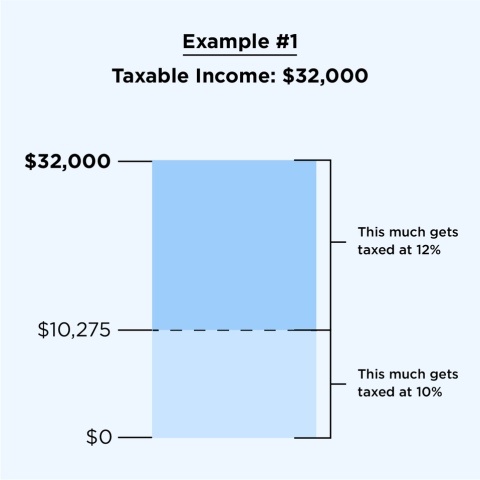

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

City Of Lansing Mi On Twitter On The August Primary Ballot Lansing Voters Are Being Asked Whether To Sell A Small Lot Next To The City Owned North Cemetery Money From The Sale

What Are Tax Lots And How Do They Affect Your Capital Gains

Tax Lots Manage Your Account Frequently Asked Questions Help Center

Tax Lot Optimization Why It Matters To Investors Level Financial Advisors

How Do State And Local Property Taxes Work Tax Policy Center

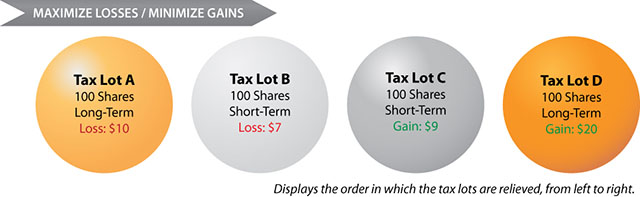

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Zoning Lot Vs Tax Lot Nyc Zoning Fontan Architecture

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

Life Changes Mean Tax Changes Part 2 United Way Worldwide

:max_bytes(150000):strip_icc()/Tax_Advantages_Buying_Home_Sketch-ffc74833ef7744f2ba7377009ff52274.png)